Programs and services

who we are

Get Involved

How to leave a legacy with planned giving

May 06, 2024 5 min read

Making decisions about what to do with your money after you pass away can be tricky. Although it can be an uncomfortable conversation, it's an important one to ensure your values and wishes are honoured.

The last thing you want is your hard-earned assets to go to the government when you pass.

If you haven't set up a Will, now is a good time to make one. Everyone should have a Will! And if you have a Will but haven't considered planned giving, it's not too late to include it.

What is planned giving?

Planned giving, or legacy giving, is a way to leave money to your favourite charity when you die. It's planned because you decide ahead of time which non-profit or charity you'd like to support and include it in your Will.

Leaving part or all of your estate to a charity is an excellent opportunity to make a lasting impact on a cause you care about, even after you're gone.

There are two ways to leave money -- residual and specific.

- Residual gifts:After fulfilling all other inheritances and obligations, a residual gift allocates a percentage of the remainder of your estate to your chosen charity.

- Specific gifts:These are precise amounts or specified assets like cash, stocks, or property.

It sounds like a lot of work

Although planned giving might sound like a lot of work, it's really not! If you're in the creation stage of your Will, it's a simple conversation with your lawyer or financial planner.

And if you already have a Will, it's a straightforward amendment that your lawyer can help you with.

Why should I leave money to a non-profit?

Deciding to leave your money to a non-profit through planned giving is a meaningful way to leave a lasting legacy. Beyond supporting the non-profit you care about to continue its impactful work, it can also reflect your personal values.

Leaving your money to a non-profit through planned giving can also help to:

Create a lasting impact: Non-profits rely on donations to fund essential programs and services. A legacy gift can be significantly larger than what you might donate during your lifetime, providing substantial support that can transform the organization's ability to carry out its mission.

Provide financial benefits: There are economic advantages to leaving money to a non-profit. Depending on where you live, it can reduce the estate tax burden on your heirs by decreasing the taxable value of your estate. It's always advisable to consult with a financial advisor or estate planner to understand the potential tax benefits.

Honour or memorialize loved ones: Many people leave all or part of their estate to a non-profit in honour of someone special. This can be a touching way to remember a loved one or to honour your family name.

Encourage generosity in others: Your decision to leave money to a non-profit can inspire friends, family, and future generations to consider how they, too, can make a difference. It sets a precedent of giving back and using one's resources for the greater good.

Experience peace of mind: Knowing that your legacy will contribute positively to the world can provide tremendous peace and fulfillment. This decision allows you to reflect on your life's achievements and how you can positively impact others.

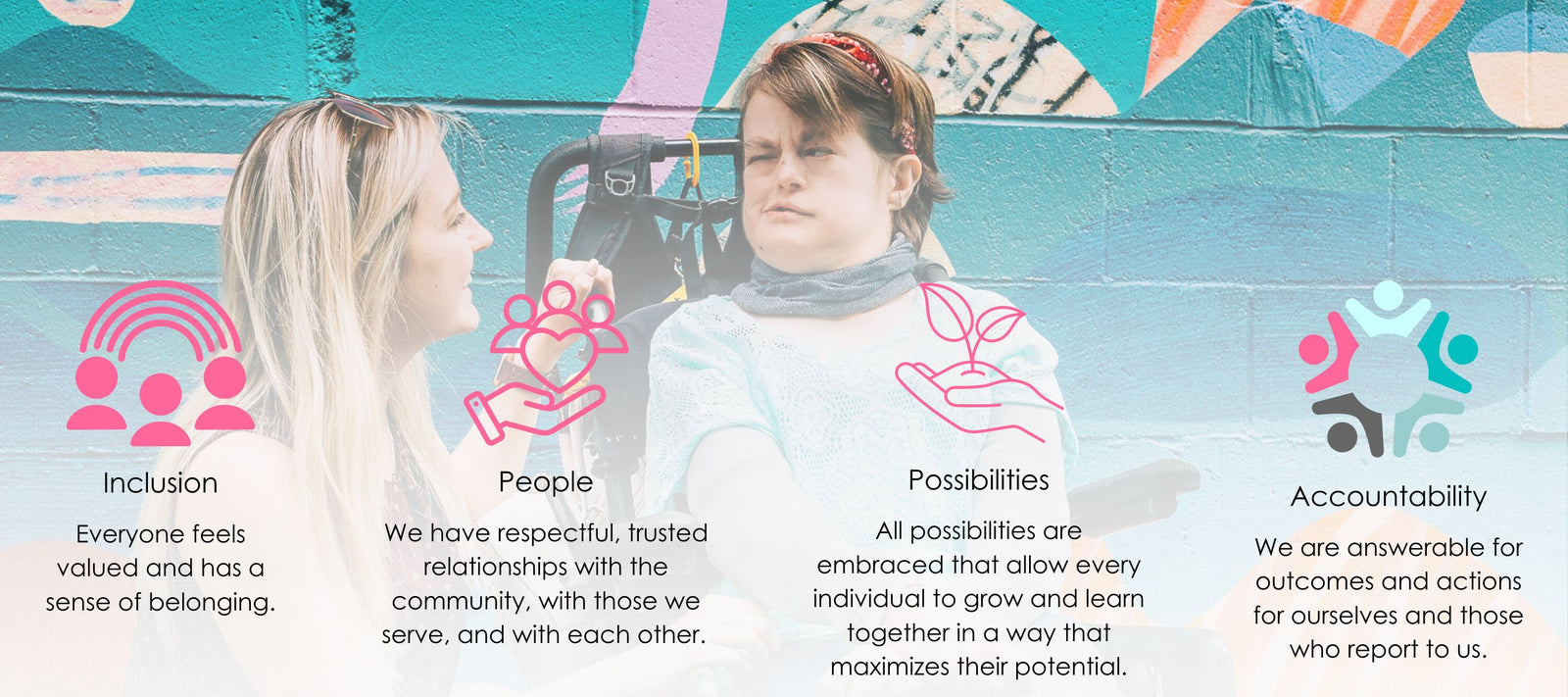

Why choose inclusion in your planned giving?

Great question! And the best place to start is the beginning because inclusion has been a part of the qathet region for 70 years. It started in 1954 with a group of parents who refused to send their children with developmental disabilities to live in institutions.

They were convinced their children could live fulfilling lives at home in their community and integrate with other children at school and through group activities.

This group of parents proved they were right. They formed a non-profit, and for the last 70 years, inclusion has profoundly impacted many lives. In fact, just in the last year we've served more than a thousand members of our community.

When you choose inclusion in your planned giving, you are contributing to the following:

Supporting vulnerable people

Your legacy giving will ensure continued support for individuals with developmental disabilities, children, and adults 65 years and older. These members of your community rely on the services provided by inclusion to lead fulfilling, integrated lives.

Your legacy can help sustain and expand these essential services, offering new opportunities and better care.

Bridging the funding gap

While inclusion receives significant government funding, it's often insufficient to cover all our programs and offerings.

Critical aspects like employee training, software upgrades, and professional development are essential for maintaining high-quality services but frequently face budget shortfalls. Your donation can help keep our staff well-trained and our technology up to date, benefiting the programs you care about.

Individual donations also contribute to our social enterprises like OneLight, Diversa, and Kindred Rebuild. These programs rely on short-term grants, yet their impact on the community is vast. They provide much-needed employment opportunities for individuals who struggle to find lasting work because of their intellectual disabilities.

Keeping these programs open provides many people in our community the chance to earn a livable wage, feel fulfilled, and wake up each day with a purpose.

Impacting the community

Including inclusion in your planned giving, you contribute directly to your local community. Because we offer programs that enhance the quality of life for a broad cross-section of qathet residents, planned giving can fund projects and services that directly impact the community, from educational programs to recreational activities, and beyond.

Feeling good about yourself

Leaving a legacy gift can give you a sense of personal satisfaction and peace of mind. Knowing that you are helping to better society and support a cause close to your heart can be deeply fulfilling. It allows you to leave a legacy that outlives you and benefits future generations in tangible, meaningful ways.

What about my family?

Money can be a touchy subject for many families, especially when children expect to receive their parent's estate.

The good news is that your children will benefit from planned giving as a charitable donation can help offset taxes on your estate. And if you don't have children, planned giving is an excellent way to ensure your estate doesn't go straight to the tax people!

Also, at the end of the day, it's your money to do with what you like!

How to add inclusion in your planned giving

Leaving a gift in your Will to inclusion is simple. You can include it in your Will by naming inclusion powell river as a beneficiary.

Important: Our official charitable name is "Inclusion Powell River Society."

Alternatively, you can reach out to us for more information.

Leave a comment

Comments will be approved before showing up.

sign up!

Join our email list to get insider news and updates.